Five Point Holdings (FPH)·Q4 2025 Earnings Summary

Five Point Holdings Posts Record $183.5M Net Income in FY 2025, Guides to $100M in 2026

January 29, 2026 · by Fintool AI Agent

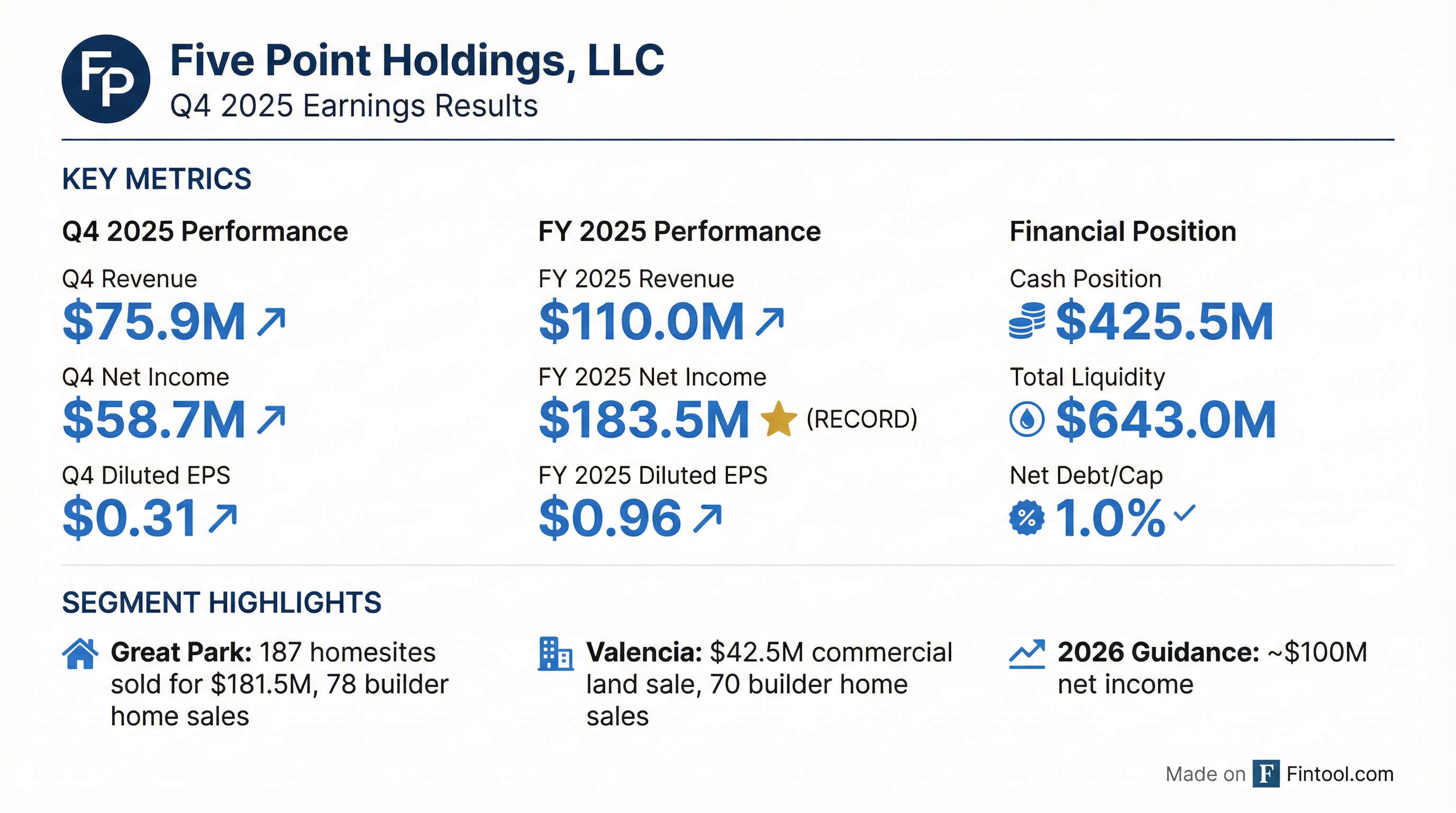

Five Point Holdings (NYSE: FPH) delivered a strong finish to 2025, reporting Q4 net income of $58.7M and full-year record net income of $183.5M—exceeding the high end of revised guidance. The California land developer ended the year with $425.5M in cash and total liquidity of $643.0M, while reducing its net debt to total capitalization ratio to just 1.0%.

CEO Dan Hedigan commented: "2025 was another record year for Five Point despite challenging market conditions... We could not have hit these operational and financial milestones over the past few years without the dedicated and focused efforts of our small and efficient, hardworking team."

CFO Kim Tobler highlighted the multi-year transformation: "At the end of 2022, we reported a $34.8 million net loss and finished the year with $131.8 million of cash. This year, we are reporting $183.5 million in net income... and are now ending the year with $425.5 million of cash and total liquidity of $643 million."

Did Five Point Beat Guidance?

Yes, significantly. Management had guided to net income "close to" 2024's $176.3M. The final result of $183.5M represents a 4.1% beat versus 2024 and exceeded expectations.

Note: Five Point does not have meaningful sell-side analyst coverage, so no consensus estimates are available for beat/miss comparison.

The YoY decline in consolidated revenue reflects the timing of land sales—Q4 2024 had a $137.9M land sale at Valencia vs. $42.5M this quarter. However, equity in earnings from unconsolidated entities (primarily Great Park Venture) more than offset this on a full-year basis.

What Drove Q4 2025 Results?

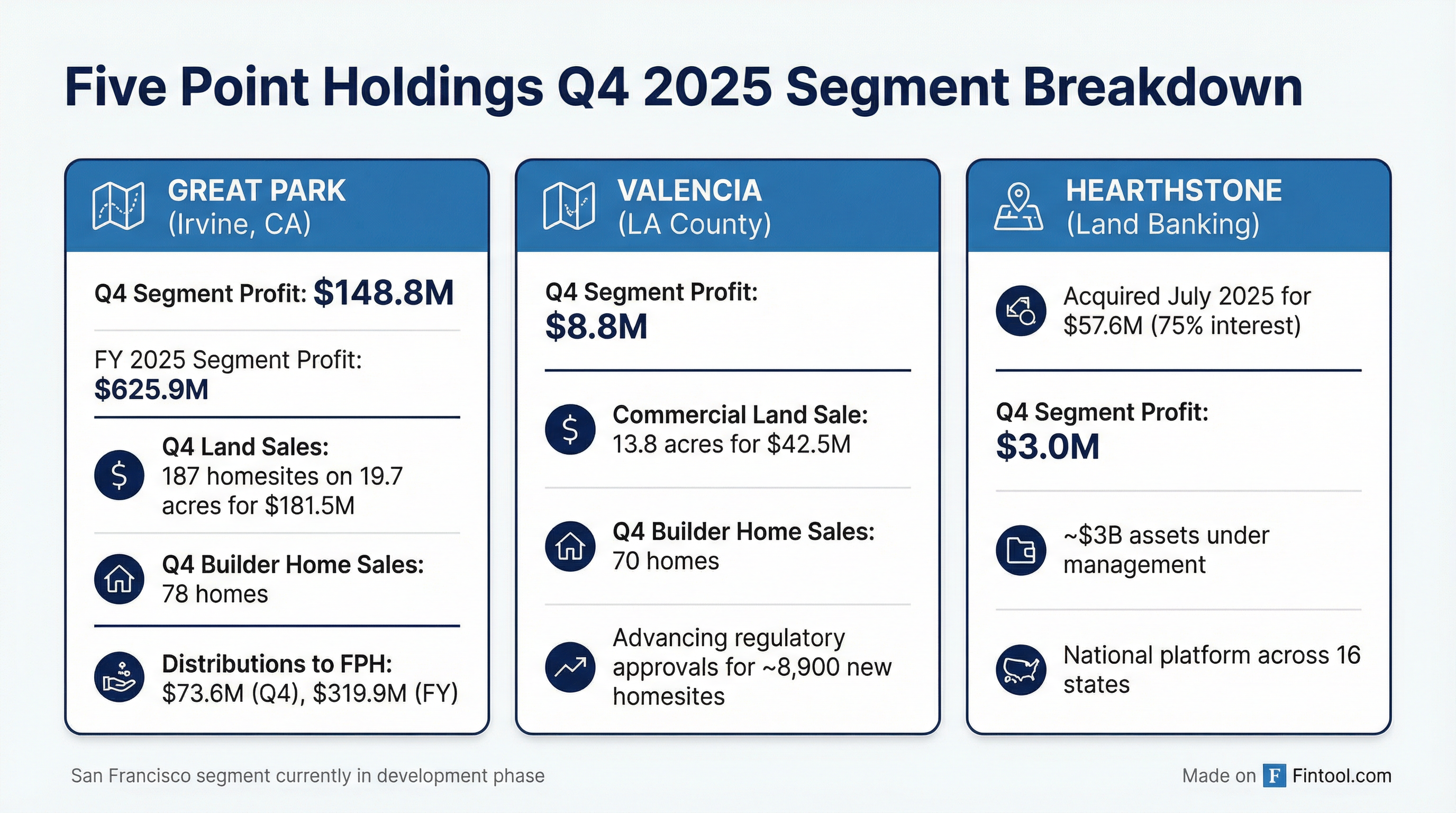

Great Park Neighborhoods (Irvine, CA)

The Great Park Venture remained the primary profit driver:

- Land Sales: 187 homesites on 19.7 acres for $181.5M aggregate purchase price (75.5% gross margin)

- Price Participation Model: Q4 sales at $9.2M per acre base price before participation upside

- Venture Net Income: $128.2M in Q4, generating $44.2M equity earnings for FPH (37.5% interest)

- Distributions: FPH received $73.6M in distributions and incentive compensation in Q4

- Builder Sales: 78 homes in Q4 (down from 187 in Q3 due to seasonality and sold-out collections)

- Active Programs: 12 currently selling, 8 additional planned for 2026

Land Remaining at Great Park:

Full-year Great Park: 920 homesites closed on 13 programs, with FPH receiving $319.9M in distributions. Currently bidding 4 new programs (~27 acres) expected to close by year-end 2026.

Valencia (Los Angeles County)

- Commercial Sale: Closed 13.8-acre commercial land sale for $42.5M (31.25% gross margin)

- Builder Sales: 70 homes in Q4 (up from 50 in Q3), 10 programs actively selling, 6 new programs planned for 2026

- Land Remaining: 55 net acres residential, 11 net acres retail, 13 net acres industrial (excluding new entitlements)

Major Entitlement Win: Received unanimous approval from LA County Board of Supervisors for Entrata South and Valencia Commerce Center :

- Entrata South: ~120 net acres residential, 1,300+ market-rate home sites, ~40 net acres commercial

- Valencia Commerce Center: ~110 net acres for industrial uses

- Critical: No litigation filed to challenge approvals—allowing accelerated development timeline

- Sales expected: Early 2028 from new entitlements

When additional villages are approved, Valencia will have 10,000+ entitled home sites to meet LA County's chronically undersupplied housing market.

Hearthstone (Land Banking Platform)

Acquired in July 2025 for $57.6M (75% interest), Hearthstone contributed $3.0M in segment profit for Q4.

Rapid AUM Growth:

- At closing: ~$2.6B AUM

- Year-end 2025: ~$3.4B AUM

- Expected Q1 2026: $300-500M in newly originated capital commitments

- Year-end 2026 target: $4B+ AUM

For 2025 (5 months post-acquisition): $11.8M revenue, $3.9M net income

Beyond Hearthstone: Management disclosed they are evaluating "middle-duration opportunities in the land ecosystem" to create additional fee-based revenue streams using an asset-light approach with outside capital partners.

How Did the Stock React?

FPH shares rose +1.8% to $5.59 during regular trading on earnings day, though aftermarket trading showed the stock pulling back to $5.43 (-2.9% from close).*

*Values retrieved from S&P Global

What Did Management Guide For 2026?

Management set 2026 consolidated net income guidance at approximately $100M—roughly 45% below 2025's record $183.5M.

Critical timing detail: Management expects a small loss in Q1 2026 since no land sales are planned that quarter. Earnings are expected to be heavily weighted toward the second half of the year as land sales and fee-based income accelerate.

Planned 2026 Land Sales:

CEO Hedigan noted: "Based on what we have seen today, we expect consolidated net income in 2026 to be approximately $100 million. We expect our earnings will be weighted more heavily toward the second half of the year as land sales and fee-based income accelerate."

The lower guidance reflects:

- Timing of land sales: 2025 benefited from large Great Park sales and the Valencia commercial transaction

- Market conditions: Ongoing affordability headwinds in housing

- Development cycle: Continued investment in entitlements and infrastructure ahead of future monetization

- Strategy alignment: Matching sales to home absorption to optimize long-term land values

Balance Sheet Strength

Five Point ended 2025 with a fortress balance sheet:

Key 2025 capital actions:

- Issued $450M of 8.0% Senior Notes due 2030, retiring $523.5M of 10.5% notes due 2028

- Increased revolving credit facility from $125M to $217.5M, extended maturity to July 2029

- Credit rating upgrades: Moody's to B2/B2, Fitch initial BB-/B

What Changed From Last Quarter?

Q&A Highlights

Alan Ratner (Zelman & Associates) asked about development spending expectations:

"What is the expectation for development expenditures in 2026 and beyond? I know you mentioned the new entitlements on Valencia, so curious if we should expect to see a ramp in development spending there. And in San Francisco as well."

Management response: Expect development capex of approximately $125M per year, consistent with 2025 levels, split between Valencia and San Francisco. The pace is being held steady as development increases at both locations.

Forward Catalysts to Watch

- Valencia Residential Sales: First residential land sale expected in 2026 after strategic delays

- Valencia Pipeline: 10,000+ entitled home sites coming from approved and pending villages

- Hearthstone Expansion: Targeting $4B+ AUM by year-end 2026, with $300-500M expected Q1

- San Francisco Development: Initial site work at Candlestick expected H1 2026

- New Growth Initiatives: Middle-duration land opportunities being evaluated

- Great Park Sales: 4 new programs (~27 acres) in bidding process for 2026 close

Key Takeaways

- Record year: $183.5M FY 2025 net income exceeded revised guidance by ~$6M

- Great Park extended runway: 155 net acres remaining after 100-acre commercial-to-residential conversion

- Valencia unlocked: No litigation on entitlements—accelerating 10,000+ home site pipeline

- Fortress balance sheet: $643M liquidity, 1.0% net debt ratio, 16.3% debt-to-cap

- 2026 cadence: Q1 small loss expected; ~$100M full-year, weighted to H2

- Hearthstone scaling: AUM grew 31% since close ($2.6B→$3.4B), targeting $4B+ by year-end

- New growth: Evaluating "middle-duration" land opportunities for asset-light fee revenue

View the full Q4 2025 8-K filing | Q4 2025 Earnings Call Transcript